Analyzing Pakistan’s Photovoltaic Market Potential by 2025

February 17, 2025

Introduction

Pakistan, a country long plagued by energy shortages and reliance on imported fossil fuels, is witnessing a transformative shift toward renewable energy. Solar power, in particular, has emerged as a cornerstone of this transition, driven by abundant sunlight, supportive policies, and urgent climate commitments. By 2025, the photovoltaic (PV) market in Pakistan is poised for exponential growth, offering opportunities for investors, developers, and communities. This report explores the key drivers, challenges, and projections shaping the nation’s solar energy landscape.

—

Current Landscape of Solar Energy in Pakistan

As of 2023, Pakistan’s installed solar capacity stands at approximately 1.5 GW, a modest figure given its potential. However, momentum is building:

- – Government Initiatives: The Alternative Energy Policy (AEDB 2019) aims to generate 30% of electricity from renewables by 2030, with solar as a priority.

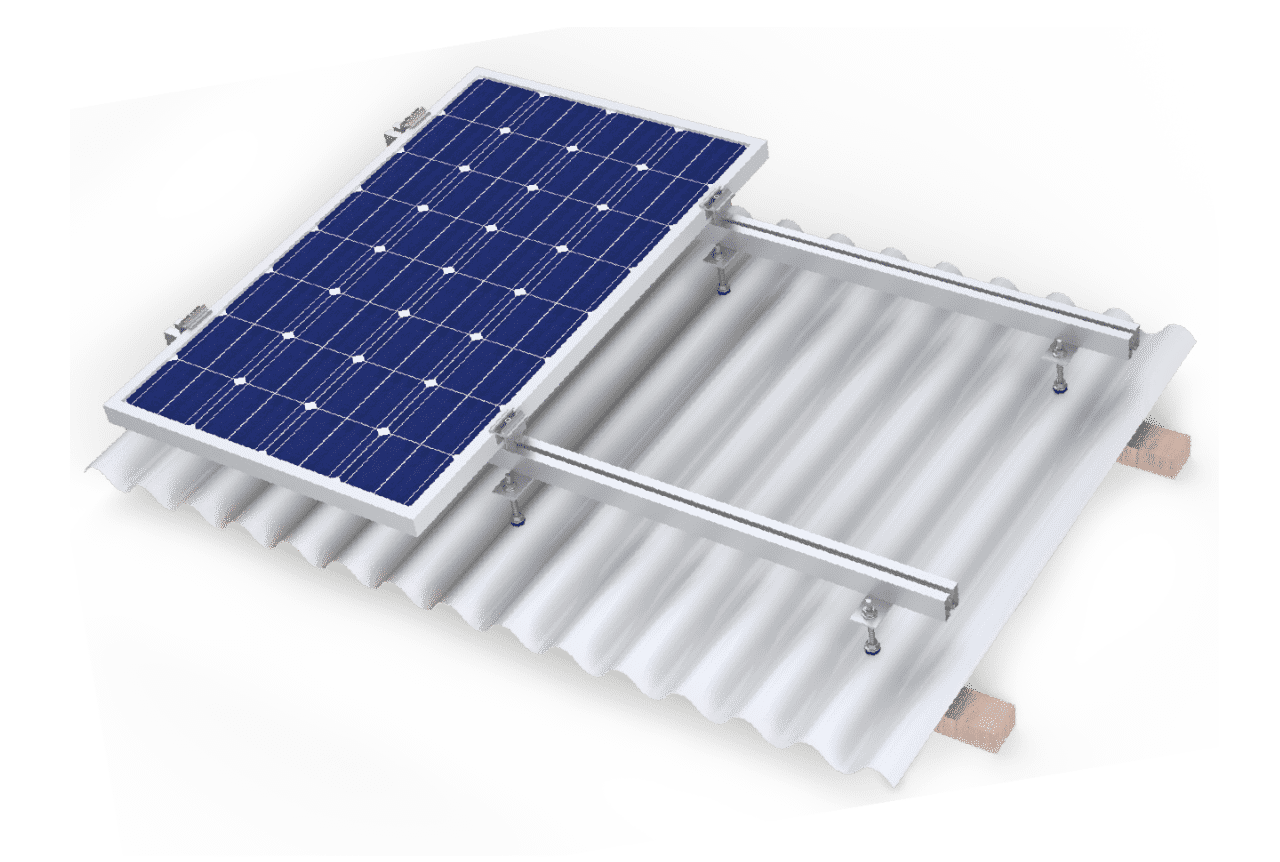

- – Residential and Commercial Adoption: Net metering policies and tax incentives have spurred rooftop installations in urban centers like Karachi and Lahore.

- – Utility-Scale Projects: The Quaid-e-Azam Solar Park (1,000 MW) in Punjab remains a flagship project, though delays highlight systemic challenges.

Key Growth Drivers for Solar by 2025

1. Energy Security Imperatives

Pakistan imports over $15 billion annually in fossil fuels. Solar offers a cost-effective alternative, with levelized costs plummeting by 80% globally since 2010.

2. Policy Tailwinds

– Net Metering 2.0: Expanded capacity limits for rooftop systems (up to 5 MW) incentivize businesses and households.

– CPEC Investments: China-Pakistan Economic Corridor projects include solar parks and technology transfers.

– Climate Commitments: Pakistan’s updated NDC (Nationally Determined Contribution) targets 60% renewables by 2030.

3. Technological Affordability

Falling prices of solar panels (now $0.20–$0.25/Watt in Pakistan) and improved battery storage solutions make solar accessible to rural and off-grid communities.

4. Electricity Price Volatility

Rising grid electricity tariffs (up 50% in 2023) and frequent load-shedding push consumers toward solar self-sufficiency.

Market Projections for 2025

Analysts predict Pakistan’s solar capacity will reach 4–5 GW by 2025, driven by:

– Utility-Scale Expansion: Tenders for 600 MW solar projects in Sindh and Balochistan.

– Distributed Generation: Rooftop solar to grow at 25% CAGR, supported by financing schemes like State Bank’s Solar Loan Program.

– Off-Grid Solutions: Solar home systems (SHS) could electrify 10 million rural households by 2025, per World Bank estimates.

Challenges to Overcome

1. Grid Infrastructure Limitations

Outdated transmission networks struggle to integrate variable solar output. Upgrades require $2–3 billion in investments.

2. Financing Barriers

High upfront costs deter small consumers. Microfinancing penetration remains low at <10%.

3. Policy Implementation Gaps

Bureaucratic delays in project approvals and inconsistent net metering enforcement stifle growth.

4. Awareness and Skills Deficit

Limited public understanding of solar benefits and a shortage of trained technicians hinder adoption.

Opportunities on the Horizon

1. Hybrid Solar-Storage Systems

Pairing solar with lithium-ion batteries (projected to drop below $100/kWh by 2025) will enhance reliability.

2. Agri-Voltaics

Dual-use solar farms for agriculture could revolutionize water-scarce regions like Sindh.

3. Export Potential

Pakistan could manufacture low-cost solar panels for regional markets under CPEC partnerships.

4. Climate Finance

Global funds like the Green Climate Fund (GCF) are earmarking $500 million for Pakistani renewables.

Case Study: Roshan Solar Program

Launched in 2022, Punjab’s Roshan Solar Program subsidizes solar systems for 50,000 low-income households. Early results show a 40% reduction in energy costs for beneficiaries, proving scalable models for rural electrification.

The Road Ahead: Strategic Recommendations

– Streamline Permitting: Create a single-window approval system for solar projects.

– Boost Local Manufacturing: Incentivize PV panel production to reduce import dependency.

– Enhance Grid Flexibility: Invest in smart grids and demand-response systems.

Conclusion

By 2025, Pakistan’s solar energy market is set to become a linchpin of its energy transition, addressing power shortages, reducing emissions, and fostering economic resilience. While challenges persist, strategic investments, policy coherence, and international collaboration could position Pakistan as a solar leader in South Asia. For stakeholders, the message is clear: the sun is rising on Pakistan’s renewable future—and it’s time to seize its rays.

Related Post

Project Inquiry

If you have a project request, please submit the form here and our sales consultant will contact you as soon as possible.